The 2020’s holiday shopping season was heavily influenced by COVID as pandemic isolation led us to spend more time on our mobile devices and with apps. eMarketer’s recently-released “US Holiday 2020 Review and Holiday 2021 Preview” shows the impact of apps and mobile especially during the Cyber Five, the five shopping days that start on Thanksgiving and end on Cyber Monday. For the past three years, these five days have made up nearly 20% of all e-commerce holiday season sales.

Holiday Season Sales

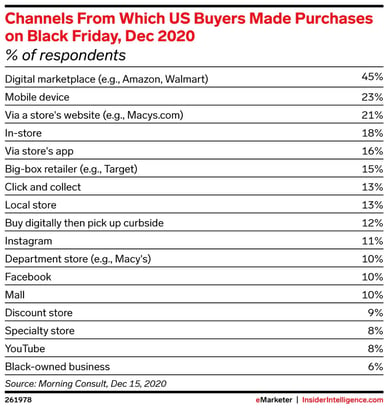

While we recovered from eating too much on Thanksgiving, we reached for our wallets and our phones. Nearly 40% of Americans made a purchase via their mobile device over the web or via an app.

Channels of Purchase

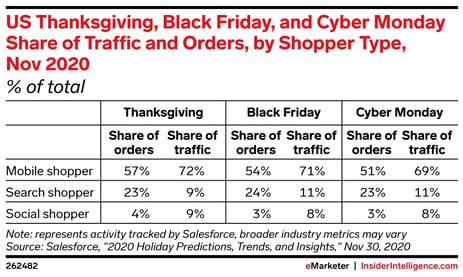

Squinting at small screens, we surfed and shopped, driving the vast majority of both orders and traffic on both Black Friday and Cyber Monday.

Black Friday and Cyber Monday

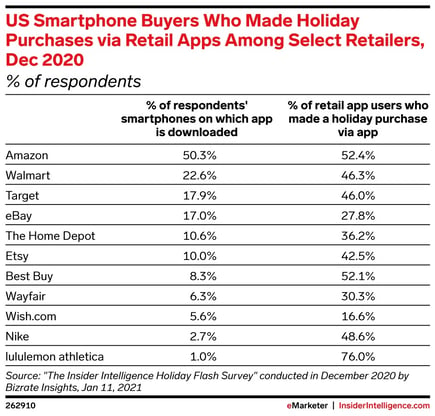

The companies that came out on top of Cyber Five sales statistics invested in and reaped the rewards of their mobile apps. Major platforms like Amazon, Walmart, Target and eBay have broad adoption of their mobile apps and these retailers saw large proportions of their users making purchases using those mobile apps. Specialty sporting goods manufacturers like Nike and lululemon athletica saw very active shoppers using their apps even though the adoption of their apps is much smaller.

US Smart Phone Buyers

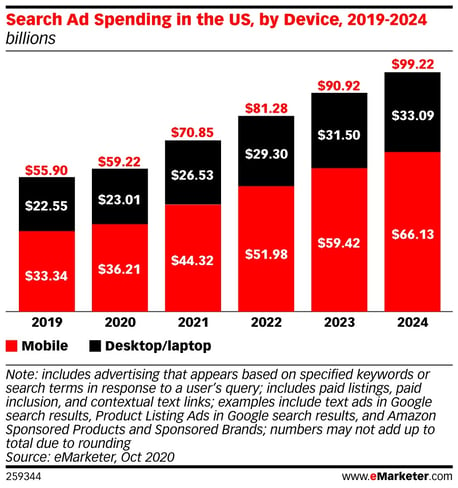

Unsurprisingly, ad dollars continued to follow our eyeballs and dollars, with the bulk of ad spend going to mobile yet again in 2020.

Search Ads Spending

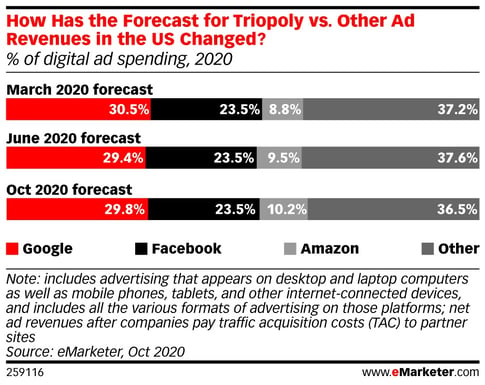

A big change that occurred in 2020 was that Amazon joined the big-three advertising “club”. Amazon took their place alongside Google and Facebook as a place where brands spend the most money to promote their products. This follows the trend whereby shoppers have started to begin their search for goods in marketplaces like Amazon with greater frequency.

Digital Ads Spending

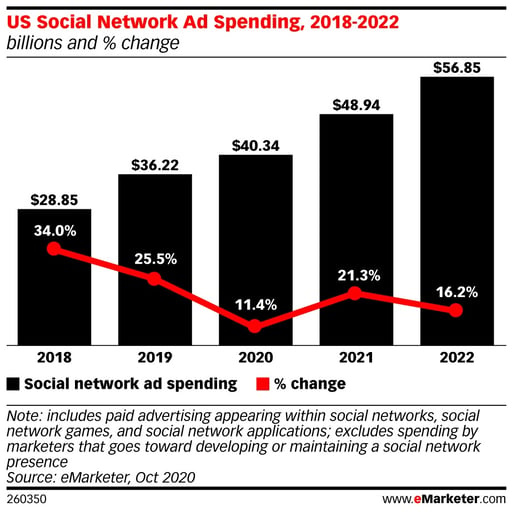

Though last year brought a lot of controversy around social media, we were all stuck in our homes and we continued to use it. And though some advertisers suspended social advertising, spend rebounded and grew overall because social performance advertising drives results for brands.

US Social Network Ad Spending

What does all this mean for brands?

- Your customers are on mobile, so you must pay attention to the brand abuse that occurs on mobile channels and develop strategies to stop it.

- Apps are an effective way of driving business, so brands should assume that malicious actors will copy your mobile success and exploit it.

- Even specialty goods companies can carve out great branding and revenue from well executed apps so they must exploit and defend this opportunity.

- Counterfeiters and other fraudsters have become digital marketing experts, and they aren’t bound by the same regulatory constraints that brands face. Brands can anticipate that bad actors will be spending more on mobile and social advertising using your trademarks.

It's more important than ever to have a strong mobile apps component in your overall brand protection strategy. For more information on how to plan an effective mobile app enforcement program to complement your overall mobile strategy, we’ve published an informative guide that you can download here.